The insurance sector is made up of approximately 7,000 companies that collect more than $1 trillion in premiums each year. The industry’s huge scale contributes greatly to the cost of insurance fraud by providing more possibilities and incentives for engaging in unlawful operations. The importance of claims investigation in insurance fraud prevention cannot be overstated.

According to the FBI, insurance fraud is projected to cost more than $40 billion each year. That indicates that insurance fraud costs the average American household between $400 and $700 per year in increased premiums. Insurance professionals can help prevent fraud by executing claims investigations properly. This article dives deep into the second step of the claims process and provides a claims investigation framework for insurance professionals.

Source: Federal Bureau of Investigation. (n.d.). Insurance fraud. https://www.fbi.gov/stats-services/publications/insurance-fraud

Investigate

Investigate

Once a claim has been reported, the adjuster will begin the second step in the claims process: investigation. The first step in this process completed by the adjuster is to determine whether coverage is applicable to a loss. The methodology they use depends on whether the claim is first-party or third-party in nature.

Understanding First-Party Claims

First-party claims are losses suffered by the insured. These are generally property-related claims. When dealing with a first-party claim, the adjuster needs to answer several questions to determine if coverage applies.

Key Questions for Coverage Determination

- Insurable interest: Did the insured have a financial interest in the property at the time the loss occurred?

- Covered property: Is the property listed on the policy, and does it qualify as covered property according to policy wording?

- Covered cause of loss: Was the loss caused by a peril that is covered by the policy, and are there any exclusions or limitations that apply?

- Policy period: Did the loss occur or start during the policy period?

- Policy limits: Are the limits adequate, and do they meet any applicable insurance to value or coinsurance provisions?

- Endorsements: Are there any applicable endorsements that add or delete coverage?

Key Consideration for Third-Party Claims:

Third-party claims involve claimants who are not insureds but have been injured or had property damaged by an insured. Third-party losses involve the determination of legal liability on the part of the policyholder. As a result, the steps to determine coverage are greater and require more information.

Investigating Third-Party Claims:

- Insured status: Does the person or organization allegedly involved in the claim qualify as an insured under the policy?

- Policy period: Did the bodily injury, property damage, or personal and advertising injury take place during the policy period?

- Occurrence: Was there an occurrence as defined by the policy?

- Legal liability: Is the insured legally liable?

- Coverage territory: Did the occurrence or offense take place in the coverage territory as defined by the policy?

- Exclusions: Are there any exclusions that apply or any exceptions to the exclusions that grant coverage?

- Policy limits: Are the limits of insurance adequate?

Determining Legal Liability

Determining Legal Liability

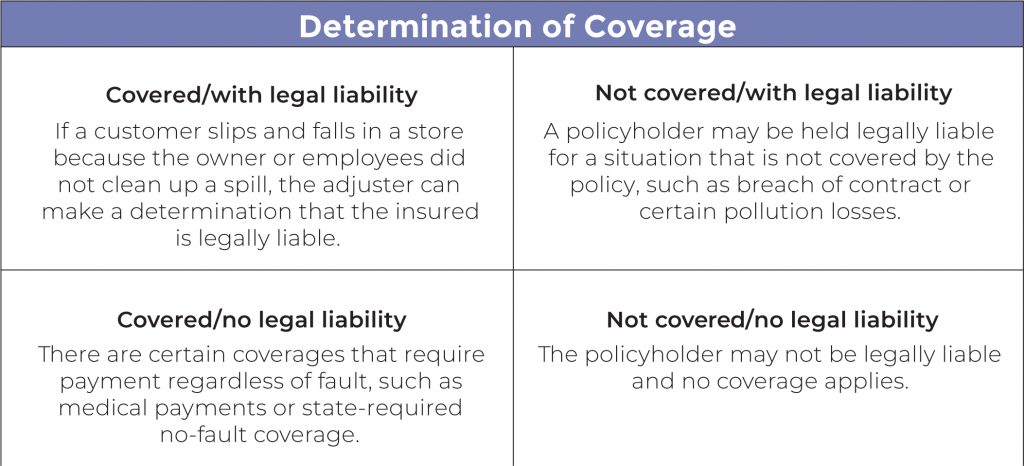

While the ultimate determination of legal liability belongs to the courts, claims adjusters must be able to understand and recognize when the policyholder may be held legally liable to settle the claim, if needed. There are several ways in which coverage may be determined and that determination may not always be based on legal liability. See the example provided.

Three types of liability affecting insurance claims

- Statutory: Statutory liability is created by law. A state’s law may establish a standard of care that is required. If that standard of care is violated, it creates legal liability. Statutory law takes precedence over contracts.

- Contractual: Contractual liability arises out of the assumption of liability by the parties to the contract. Known as contractual risk transfer, assumption of liability is quite common in agreements. Not all contractual liability assumptions are covered by an insurance policy.

- Tort: A tort is a civil wrong other than breach of contract. There are several types of tort liability.

• Negligence: Negligence is liability based on the failure to exercise the appropriate amount of care for certain circumstances. Sometimes basic negligence is known as the “prudent person rule.” This rule describes the failure to do what a prudent person would do under similar circumstances.

Elements of Negligence

Elements of Negligence

Duty owed: the offending party has a duty owed, such as a duty to safely operate an automobile on the streets.

Duty breached: the offending party must have breached that duty, such as running a red light.

Damages: there must be damages, such as bodily injury and property damage.

Proximate cause: the breach of the duty must be the proximate cause of the damages, such as the running of the light caused a collision that resulted in injuries to another

- Intentional torts: Intentional torts involve acts that are intentionally committed. The harm they cause may or may not be intentional. For example, the security guard at the local retail store grabs someone for shoplifting. After the police are called, it is determined that the person did not take any property. The security guard intentionally held the customer until the police arrived. However, they security guard did not intend to wrongfully detain the customer.

- Strict liability: Strict liability is generally found with products liability and similar situations. In strict liability situations, it’s up to the party subject to strict liability to prove that they were not negligent. A carpenter is injured when a saw he is using sends a splinter into his eye. He sues the manufacturer for the injury. During the investigation, it is determined that the carpenter removed a safety device designed to keep debris from coming back into the user’s face. The saw manufacturer can use this fact to defend against the suit.

- Absolute liability: Absolute liability is liability that is imposed without regard to fault. In some jurisdictions, dog bites and swimming pool accidents involving children are examples of situations that can create absolute liability. Others may involve pollution or liquor liability.

Duty to Defend: Understanding the broader responsibility of insurance companies

During the investigation process it may be required that the company defend the policyholder because of lawsuits. With insurance policies, the duty to defend is much broader than the duty to indemnify or pay on behalf of the insured. The company may need to provide defense even when the insured is not legally liable. When a lawsuit is filed against an insured it can contain several allegations. If at least one of the allegations is true and potentially covered by the policy, the insurance company must defend the entire lawsuit.

What Triggers Defense?

When determining if potential coverage exists, the adjuster compares the lawsuit with the policy. If any of the allegations in the lawsuit would be covered by the policy if true, the insurance company owes a defense of all allegations in the suit. Sometimes referred to as the “four corners test” or the “eight corners test,” the assessment compares the four corners of the policy against the four corners of the lawsuit.

In some jurisdictions, outside evidence and information not contained in the policy or the lawsuit may be considered in determining whether coverage will apply. This is known as the “extrinsic evidence rule.”

If either of these tests show that none of the allegations trigger coverage in the policy, then the insurance company has no duty to defend. While an adjuster may use deductive reasoning in making some decisions regarding a claim, as noted above, only the court can make the final determination of the policyholder’s liability.

Detrimental reliance in insurance claims

Detrimental reliance occurs when one party is reasonably induced to rely on a promise made by another party. For a policyholder, the act of investigating a claim may create the appearance that coverage exists in the policy even though it does not. This is why it’s very important for the adjuster to be clear with the policyholder when taking action on a claim.

Example: If the adjuster gives names to the insured of preferred body shops for repair estimates on a vehicle after a collision loss, and the insured does not have collision coverage on their policy, this could be construed as confirming coverage. This creates detrimental reliance if the insured has a shop begin repairs.

Avoiding Estoppel Situations

When the insured relies on the coverage implication to their detriment, a situation known as estoppel is created. According to Black’s Law Dictionary, estoppel is: “An affirmative defense alleging good-faith reliance on a misleading representation and an injury or detrimental change in position resulting from that reliance.” Consequently, the insurance company is “estopped” or stopped from enforcing the exclusion and must provide coverage.

To avoid estoppel in situations where the investigation must be completed prior to determining coverage, one of two processes can be used.

ROR Letter

The first process is known as a Reservation of Rights (ROR) Letter. The ROR is a unilateral document, meaning it is only signed by one party: the insurance company. The letter is sent by the insurance company to the policyholder advising them that although there is a question about whether a loss is covered, the insurance company will proceed with the investigation of the claim but reserves its right to deny the claim later.

Non-Waiver Agreement

The second process is known as a non-waiver agreement. This document is bilateral, meaning that it is signed by the insurance company and the insured. It’s a contract or agreement acknowledging that there is a potential issue with coverage, but that the investigation of the claim will proceed while the issue is being resolved. The company reserves the right to later deny coverage.

Declaratory Judgments

Sometimes the insurance company will want the court to interpret or clarify policy language prior to making a coverage decision. In this case, the company representatives will request a formal hearing with a judge, allowing the court to give its interpretation. While the court’s decision regarding the clarification stands, it does not provide for or order enforcement of the policy.

Use of Outside Investigative Sources

Outside Services

The investigation process may require resources that involve the services of others. These services may be used to obtain additional information that is needed for the adjuster to make a proper coverage decision. Outside services could include those of private investigators, cause and origin experts, vocational experts, independent medical examiners, forensic accountants, consulting engineers, and accident reconstructionists.

Impact on Case Reserve

A case reserve is an estimate of the amount for which a particular claim will ultimately be settled. As the investigation process turns up more details, the case reserve may need to be increased because of the updated information. If required, the use of outside experts will likely come at a cost. These costs must be included in the incurred loss calculation as allocated loss adjustment expense (ALAE) since they can be allocated to a specific claim.

Once a thorough investigation is conducted, a case report is created. It summarizes the most convincing facts of the case and does not express a viewpoint, simply the facts and findings. In circumstances of disputed facts and doubtful proof, the report is critical since it will enable the insurance company to make a final decision on how to proceed. The process continues to verification, evaluation, and resolution of the claim.

In conclusion, risk and insurance professionals play a critical role in preventing fraud by conducting thorough claims investigations. By following the framework laid out in this article, insurance professionals can ensure that claims investigations are executed properly, helping to reduce the frequency and impact of insurance fraud, benefitting the industry, protecting policyholders, and keeping insurance premiums affordable for all.

To learn about all the steps in the claims process and improve the services you provide for your clients, register for an upcoming CIC Insurance Company Operations course.