KATHLEEN HICKS, CIC

President – HR&R LLC

WHAT IS A DIFFERENCE MAKER?

Difference Makers are everyday people doing extraordinary things.

Hear from Insurance and Risk Management experts working tirelessly for the greater good.

KATHLEEN CHARTED A PATH FOR WOMEN IN THE INDUSTRY

Kathleen started her career at the age of 19 when she applied for a job through the Texas Workforce Commission. After testing high in math, she took a job in the accounting department at United States Fidelity & Guaranty Insurance Company.

“My education from The National Alliance empowered me to compete with anybody and not be intimidated.”

Kathleen’s boss encouraged her to attend a CIC course, but did not expect her to take the exam. She was 1 of 10 women in a class of 125 participants. Kathleen took all the required courses and earned her CIC designation in 1978.

KATHLEEN HAS HAD MANY UNIQUE CLIENTS DURING HER CAREER

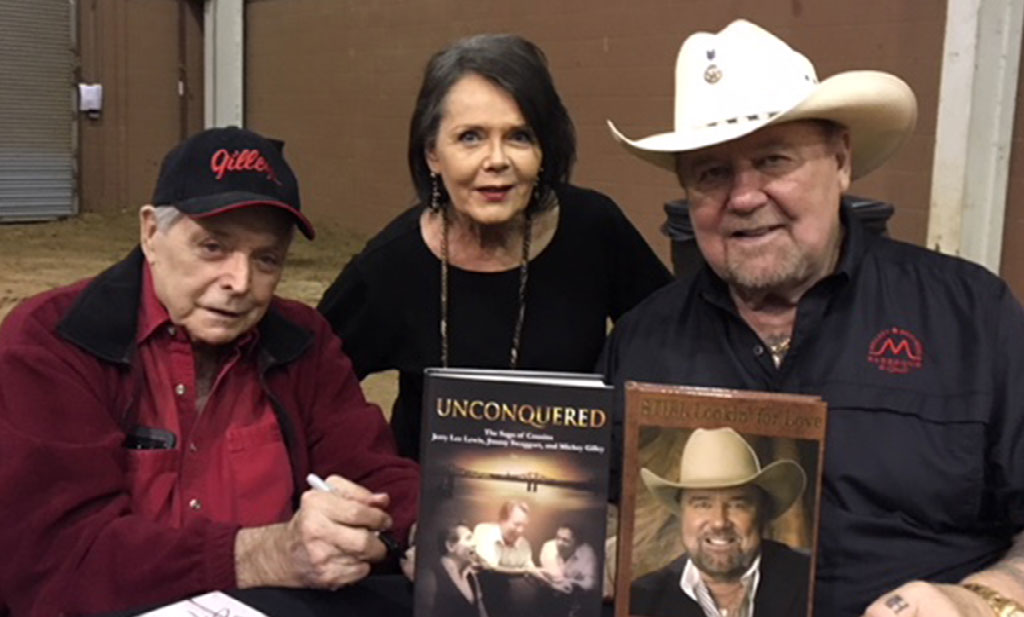

Kathleen met Mickey Gilley while operating her company, Rogers & RogersInsurance & Risk Management. Mickey owned Gilley’s Club. The club was the primary site for Urban Cowboy and housed a mechanical bull. Due to the film’s popularity, other venues wanted to buy mechanical bulls but needed liability insurance to do so. Kathleen secured the first liability insurance for mechanical bulls for a $2,500 per bull annual premium that included a stipulation requiring cowgirls and cowboys to sign a waiver before their ride. Kathleen and her team never had a claim.

“My designation gave me confidence. If I could read an insurance policy and put it to work, I could accomplish great things.”

Kathleen acquired an even more famous client while she co-owned Miller-McCrocklin Agency in San Marcos, Texas. The local radio station called and said Willie Nelson’s 1986 July 4th fundraiser for Farm Aid II was about to be cancelled because the backers were having trouble securing insurance. Although she had never placed event coverage, Kathleen met with Willie, discussed his needs, and secured proper insurance coverage. In less than a week, she used best-practices risk management techniques and reduced coverage costs by over $200,000. The Miller-McCrocklin Agency donated their commission to Farm Aid II to benefit struggling family farms.

KATHLEEN'S TEAM WAS AMONGST THE FIRST RESPONDERS IN THE AFTERMATH OF HURRICANE HARVEY IN 2017

Hurricane Harvey made landfall in Texas on August 25, 2017 and struck Rockport-Fulton the next day. Insurance agents from across the state helped people file nearly 670,000 Claims so they could restore their lives.

“Insurance and Risk Management is something that inspires me. With superior educational opportunities, like those offered by The National Alliance, we can make a difference in people’s lives.”

The Regional Pool Alliance Property Disaster Recovery Team was on site immediately after Hurricane Harvey hit. They met with the county judge and other local officials, superintendents, school district operations directors and business-finance officials. Engle Martin Claims Professionals coordinated the claims process and kept recovery moving forward.

CREATING A LEGACY: SABINE PASS INSURANCE CURRICULUM

Kathleen’s passion for Insurance and Risk Management drove her to implement a high school program in Sabine Pass, TX. She knew the program would pique student interest and inspire them to join the Insurance and Risk Management industry.

“I started working in insurance when I was so young. I know high school students are very capable of working in this industry. They are smart.”

Since the community had endured Hurricanes Rita and Ike, Kathleen and Sabine Pass Superintendent, Kristi Heid, agreed this was a wonderful opportunity for the school district. They received special funding to start a pilot program. The program was a resounding success!