ENVIRONMENTAL STRATEGIST

Learn how to advise clients on managing and transferring environmental exposures.

Insurance Sales Training

Elevating Careers Through Proven Sales Techniques and Strategies

ONLINE SUBSCRIPTIONS

Subscribers can accelerate their learning, and save up to 60% on earning designations.

NEW DESIGNEE DIRECTORY

Dues-Paid Designees can elevate their presence by opting into the new directory!

Get Unlimited Risk & Insurance Online Learning.

Nationally Recognized

Risk Management & Insurance

Designation Programs

Earn your designation quicker with

an Online Subscription Membership!

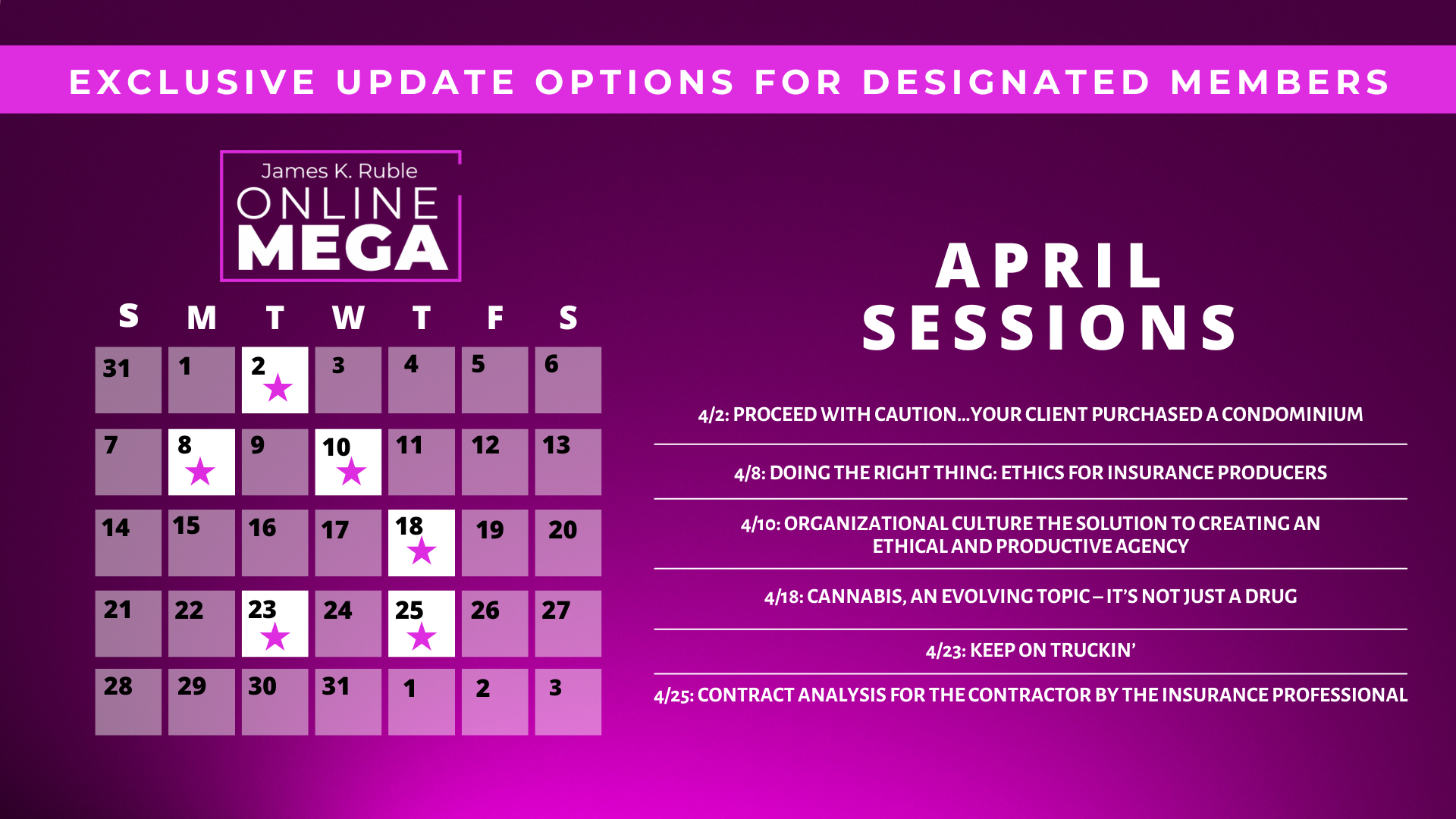

Upcoming 1-Hour Webinars

Foundational & Essential Courses

Specialty Programs & Seminars

Do you know how to protect commercial clients from environmental exposures?

The Environmental Strategist (eS) course educates insurance professionals on how to advise clients as they manage and transfer their environmental exposures.

50+ Years of Trusted Education.

4.85

Average Subject Rating

4.70

Average Faculty Rating

Our practical risk management and insurance courses are taught by active insurance practitioners, include policies and forms currently used in the field, and guide you through real-world scenarios to give you a deep understanding of what your clients are facing today. The knowledge and skills you develop in any one of our courses or designation programs can be put to use immediately and make your career soar.

What Our

Participants Say

- All

- Awkward Insurance Podcast Series

- Difference Makers Podcast

- Innovation Expo

- Nat Alliance NOW Podcast

- Press Releases

- Resources

Exploring AlliBot: AI-powered Tool for Risk & Insurance Professionals

AlliBot: An AI Knowledge Bot for Risk & Insurance Professionals

Meet The Alliance: Beth Benhart

Advance Your Skillset This Earth Day with the Environmental Strategist Online Course

Risqué Insurance: Tattoos, Piercings, and Spas Oh My!

Workers Compensation – It’s Weirdly Different

Crime Coverage in Business Risk Management

Difference Makers Podcast: Educational Excellence in Surety Bonds