The Certified School Risk Manager (CSRM) designation is known for providing career-building expertise and credibility within the school system and community.

Prove you’re a pro—earn the designation that matters—CSRM. Educational institutions require professionals who know how to identify today’s risks and plan for tomorrow’s challenges! CSRM is a designation program that allows you to expand your skills and enables you to apply quantitative and qualitative techniques to estimate the impact of risks in your school.

CSRM provides you with an introduction to risk management concepts as well as practical knowledge and strategies. CSRM is right for you if you:

- are a Superintendent of Schools, Business Official, Risk and Safety Manager, School Administrator, Head of School,

- are employed by a K-12 public or private school a charter school, a community college or university, or

- are a licensed agent, account manager, underwriter, broker, or adjuster.

With these professional interests, you can focus in on CSRM courses and build your knowledge of the unique needs and exposures in the educational sector and increase your marketability!

Earning the CSRM designation demonstrates that you understand your school’s safety and risk requirements and can identify the different types of risk the students, faculty, staff and ultimately, the community are exposed to everyday.

Earn your designation quicker with a Intermediate Subscription Membership!

These are the times clients and colleagues need you the most.

Educational institutions require professionals who know how to identify today’s risks and plan for tomorrow’s challenges. The self-paced CSRM online designation program allows you to expand your skills and enables you to apply quantitative and qualitative techniques to estimate the impact of risks in your school.

CSRM provides you with an introduction to risk management concepts as well as practical knowledge and strategies. Earning the CSRM designation demonstrates that you understand your school’s safety and risk requirements and can identify the different types of risks the students, faculty, staff, and community are exposed to every day.

CSRM Courses

Level up your entire school risk management team’s administration abilities with implementation and communication tools and skills!

Participants will learn to implement and monitor the school risk management program, along with communications tools, the risk management information system (RMIS) and processes for delivering resources to the district, such as request for proposals and competitive sealed bids. The establishment of a district code of ethics and an ongoing ethics program concludes the course.

Topics:

- Introduction to Administering School Risks—The Risk Management Process

- The School Risk Management Team

- Communicating with the Risk Management Team

- Implementing the Risk Management Program

- Monitoring the Risk Management Program

- Ethics and the School Risk Manager

Register

Take an in-depth look at the overall risk management process, while examining the function of the school risk manager.

This foundational risk management course benefits school risk managers, employee benefits and safety coordinators, and those in human resources and positions that oversee the risk management function in schools. Insurance agents and brokers who work with school risk managers or the placement of school business are also encouraged to attend.

Take this course for an in-depth look at the overall risk management process while examining the function of the school risk manager.

Topics:

- Risk Management Function and Process

- The School Risk Manager

- Identifying School Risks: Logical Classifications

- Identifying School Risks: Methods

- Gathering Loss Data

Register

The alternatives for funding school risks and the key financial issues that risk managers face will be clarified and explained in this fundamental course.

The primary focus of this course is to introduce and explain the methods that can be used to finance the district’s losses. Using general criteria, the risk manager compares and evaluates the various risk financing options and ultimately determines which is best for the school district.

Topics:

- Introduction to Risk Financing

- Total Cost of Risk

- Risk Financing Team

- Insurance Coverages

- Deductible Plans

- Pooling & Self-Insurance

- Insurance Placement

Register

This course covers the risk control step of the risk management process. Participants will study risk control fundamentals, the purpose and elements of a safety and health plan, identification of hazard controls, and effective management of school claims as a post-accident loss control reduction technique.

Topics:

- Fundamentals of Controlling Risk

- Safety & Health Programs for School Districts

- School District Exposures

- Managing School Claims

Register

Participants will learn to analyze and evaluate school risks, along with the mechanics of forecasting and trending losses to be used in estimating loss projections, determining insurance program retentions, and deductibles.

Topics:

- Introduction and Qualitative Analysis for School Risks

- Qualitative Risk Assessment and Loss Run Analysis

- Quantitative Analysis: Tools and Forecasting

- The Risk Analysis Process

Register

Learning Options

Self-Paced Online

- Courses are accessible by computer, tablet, or cell phone—24/7 with an amazing 60-day period to complete (currently, the notebooks and other documents are not optimized to read on your phone)

- Enjoy the easy-to-use learning environment—navigate freely

- You’re in charge—the courses are self-directed! Stop and start your sessions anytime—your place will be saved

- You’ll find helpful interactive Knowledge Check exercises with great feedback

- There are self-quizzes to check comprehension—passing is required to advance to the next lesson and to take the exam

Instructor-Led Online

- Live, instructor-led webinars - Interact and chat with your instructor, study real-world scenarios.

- Instruction by the same expert faculty—with the ease of a webinar.

- Convenience—use your computer, tablet, or cell phone.

- 7 Hours of Webinars, delivered over 2-4 Weeks.

- Extended study period for exam-takers.

- Instructive quizzes, optional reading assignments, exercises, and discussion board postings.

- Complete the 1-hour proctored final exam to earn designation credit.

In-Person Classroom

- One-day courses packed with powerful skill and career-advancing instruction, followed by an optional 1-hour exam—passing the exam is required to earn the designation

- Get concrete, current examples and case studies presented by top-notch faculty to help you apply what you learn

- Train your entire team and save money by bringing National Alliance programs to your organization or school location—contact Business Development at 800-633-2165 or email alliance@scic.com.

Online Learning is easy-to-use and engaging

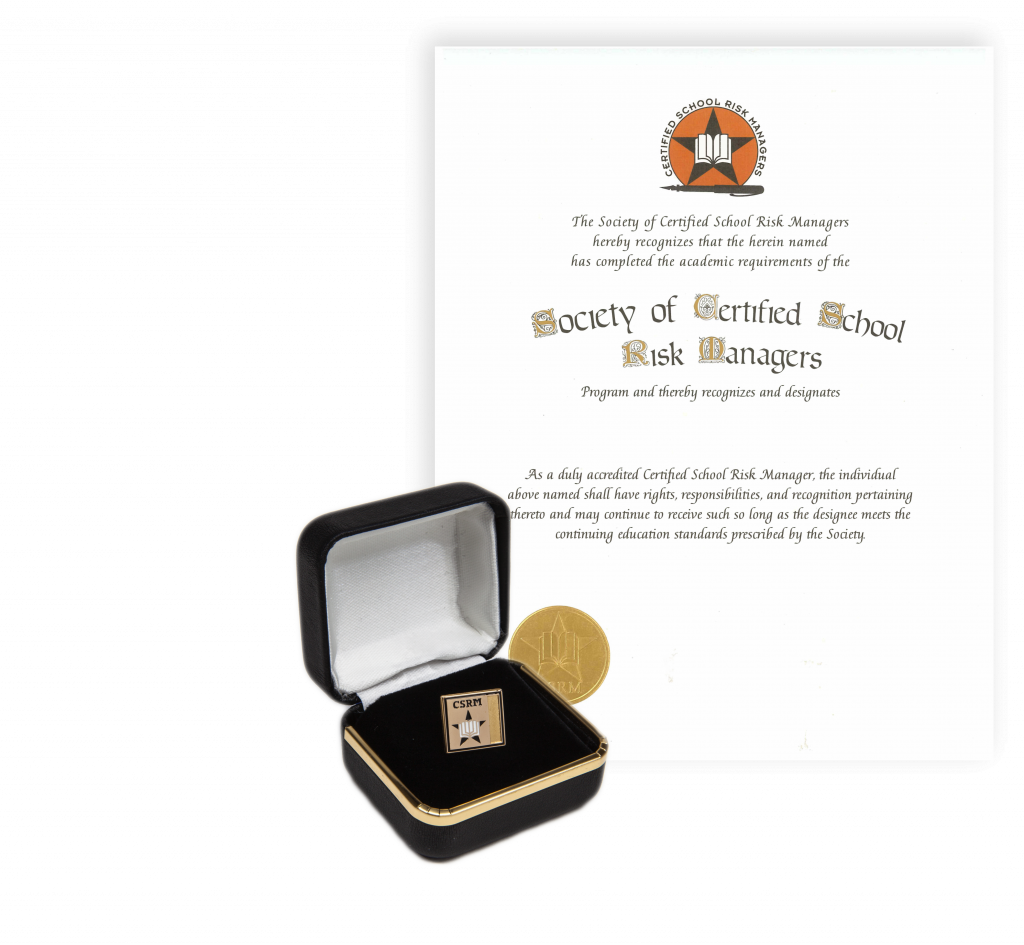

Designation

Prove you’re a pro—earn the designation that matters—CSRM.

Earning the Designation

Take the five CSRM courses and pass the corresponding exams within three calendar years after you pass your first CSRM exam.

How to Keep Your Designation

After earning the CSRM designation, you must meet an annual update requirement. Choose from the list provided, classroom or online. Please note that CSRM online self-paced courses require completion of all quizzes and review test for designation update.

- Certified Insurance Counselor (CIC) course

- Certified Risk Manager (CRM) course

- Certified Personal Risk Manager (CPRM) course

- Ruble Seminars: Dues Required- Updates Two Years

- PROFocus Series: Dues Required- Updates Two Years

- MEGA Seminar: Dues Required (16hr MEGA updates for 2 Years, 8 hr MEGA Updates for 1 Year).

- Dynamics Series: Dues Required- Updates Two Years

- 4-Hour PRO C.E. Courses (formerly William T. Hold Seminars)

- William T. Hold Seminars—Classroom (7-hour)

- Dynamics of Service—Classroom (7-hour)

- Certified School Risk Manager (CSRM) course

- Certified Insurance Service Representative (CISR) course

A status available to designees who are ready to retire, but not ready to give up the designation for which they worked so diligently and maintained for so many years. Emeritus status is maintained with annual dues payment and no annual update is required. The Emeritus status guidelines are:

- Candidates must be retired from the insurance or risk management industry.

- Years you held the designation plus age must equal 70 or greater.

- Must be dues-paid members in good standing.

The Tenured status is available to active National Alliance designees who have held their designation(s) for 25 or more years, OR for designees who have not held the designation for 25+ years, but are 70 years old or older, AND who are in good standing (having completed their 2022 update) and are dues-paid members of the Society.

National Alliance designees eligible and qualified for Tenured status may maintain their designations by paying their membership dues every year and meeting their birth month update requirement every other year rather than annually. Tenured designees retain all rights and privileges of the designation and of their membership in the Society.

Benefits

What's in it for

Your Students & Faculty?

- A safe and healthy environment that is conducive to learning

- Confidence in school’s crisis management and response plan

- Non-interruption of educational services and experience

What's in it for Your Agency or Company?

- Increased workplace safety and compliance

- Better loss prevention strategies that translate into budget savings

- Ability to identify and control future challenges

- A trusted leader who can implement an effective risk management plan

- An employee with a respected designation to protect budgets, assets, and people

What's in it for You?

- A professional designation with industry recognition

- Practical and transferable knowledge and risk management strategies

- Ability to maximize efficiency and effectiveness of existing risk management program

- Emphasis on real-world information that provides best-in-class knowledge

- Career-building expertise and credibility in the school system and community

Try something new.

Keep earning your CE and continue your professional development.

The knowledge and skills you develop in any one of our online courses or designation programs can be put to use immediately, helping you thrive even in uncertain times. Whether you’re new to your career or a seasoned professional, The National Alliance for Insurance Education & Research is here to help you keep learning and succeeding.