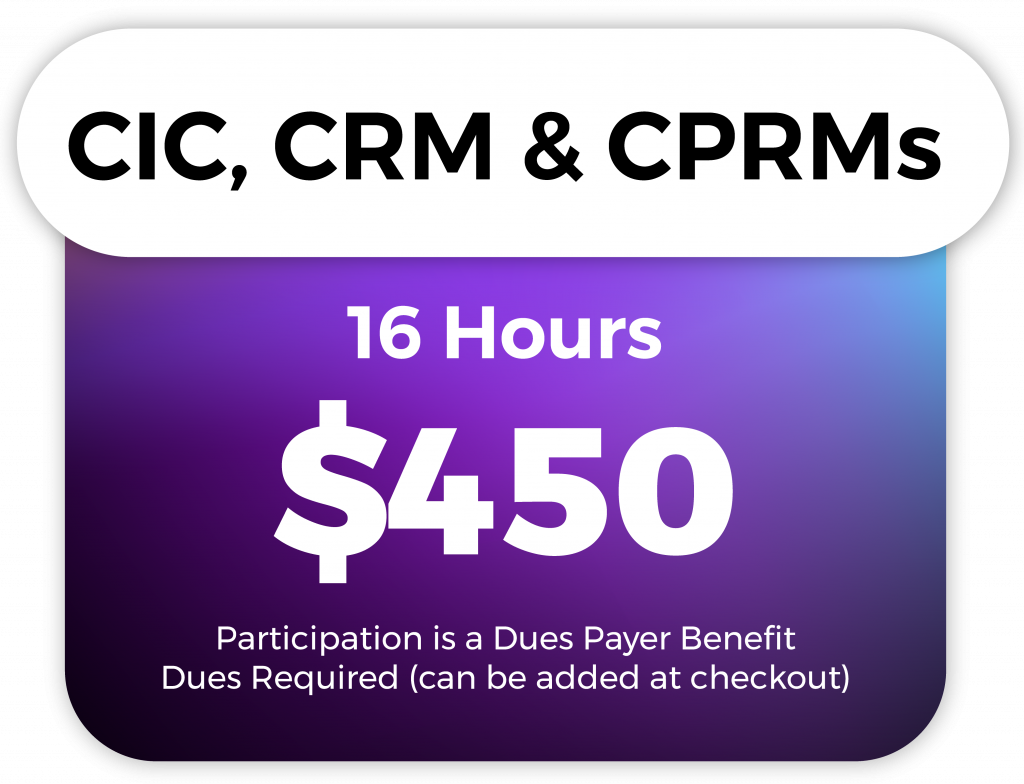

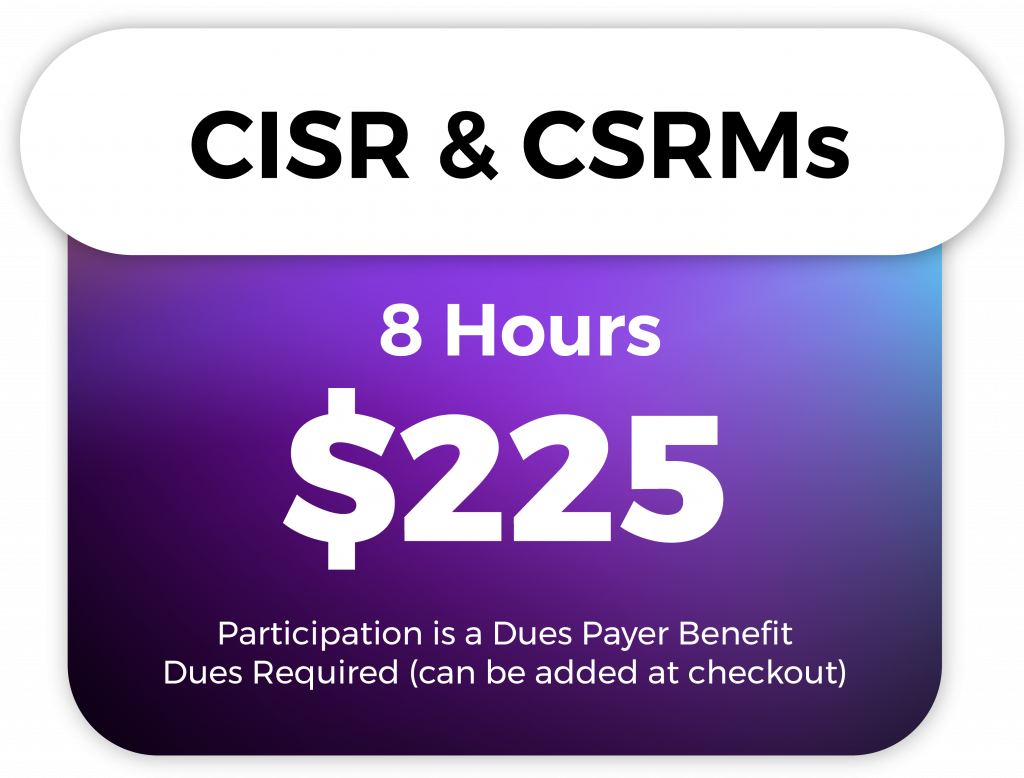

8 or 16-Hour Self-Paced Update Options!

The NEW On-Demand MEGA Seminar

satisfies your update requirement.

Log on any time, day or night, 24/7.

State CE Credit Not Currently Offered

A New Update Option!

To earn your yearly update credit, register for the

On-Demand MEGA Seminar, a dues-paid designee exclusive video program of some of our most popular James K. Ruble sessions you can

take at your own pace.

On-Demand Topics:

The trend toward mainstreaming and legitimizing marijuana is here and will continue to have a significant impact on the insurance industry. With that trend comes new regulations and a huge number of insurance questions and issues. Even today, there seems to be misunderstanding about the differences between hemp and cannabis. After a brief review of the history of cannabis in the U.S., participants will discuss the legal and regulatory issues. They will learn how the 2018 Farm Bill changed the landscape and what it effectively did. Using current ISO forms, they will examine insurance coverage considerations with farm, general liability, commercial property, as well as endorsements. They will discuss other associated issues and challenges with insuring hemp and cannabis risks including banking problems, transportation, medical marijuana and workers compensation, product liability, D&O, crime, E&O and medical professional, employment practices liability, and cyber.

Participants will be aware of the benefits afforded them of a Health Savings Account (HSA) and Long-Term Care (LTC) Insurance. They will understand the HSA and how it is created. They will also understand Medicare and Medicaid as they relate to LTC and LTC Insurance. They will learn what LTC insurance is, what it costs, what services it covers, and who should purchase it. They also learn the tax advantages of having an HSA and LTC Insurance. By explaining state partnership laws and the benefit of depositing LTC premiums into an HSA, they may also recognize the tax benefits of this process and how the programs work well when they are both purchased.

Certificates of Insurance and the related issue of Additional Insureds are often sources of frustration, confusion, and E&O claims for the insurance producer. In this session, agents will review critical things to consider before issuing a certificate and identify ways to avoid some of the common problems and errors.

Develop environmental awareness and understand how to help businesses manage and transfer their environmental exposures.

(Final Exam Required for State CE Credit)

There are certain things every insurance producer should understand before writing commercial liability coverage for a client. What does bodily injury mean and does it include claims for emotional injury? What does the duty to defend in a CGL policy really mean and how does it work? What is the difference between subrogation and contribution, and how do our policies address waiver of subrogation? What are the possible coverage triggers under occurrence form policies, and how are costs allocated when multiple policy periods respond to a loss? How do claims made and claims made and reported policies work?

Do you know what to do when a crisis occurs? Uncover the insurance implications and general principles of crisis response for active assailants, product recalls, and data breach/cybersecurity incidents. Analyze a data breach claim and form a plan of action.

Participants will gain a better understanding of cyber risk exposures and why businesses need cyber liability coverage. They will examine first-party and third-party exposures related to cyber risks, coverage limitations in standard liability policies, and major provisions commonly found in cyber liability insurance policies. They will review solutions that include cyberspace specific products and risk management.

Insurance professionals will discuss the reasons why sales managers fail and reasons why sales managers need a selection and hiring process. Traditional hiring approaches don’t work. In this session, insurance professionals will learn the steps and methods necessary to effectively identify, hire, and select the right producer candidate. They will discuss specific skills required and critical sales traits of the candidate. They will discuss the costs of making a bad hiring decision and the benefits of a planned selection and hiring process.

The participant will learn how life and health insurance products take the uncertainty out of business planning. The program will specifically discuss the risks that face every business owner, death, disability and retirement, and how to mitigate these risks.

Participants will examine the concerns that exist when clients offer property and/or use property of others via popular web-enabled services such as VRBO, Couchsurf, Airbnb, and similar platforms. They will explore the most commonly used Homeowners Coverage forms, Personal Auto Policy, Recreational Vehicle Coverage forms, Watercraft policies, and the endorsements that can be used to provide coverage for these unique exposures. They will better understand the coverage issues that may arise when these items are shared with others.

The art of creating a compensation plan that is designed to your unique agency needs and balanced to provide the producer with both financial security and limitless rewards based on performance will be studied in this hands-on practical approach to one of the foundational elements of Agency Management.

Identify the reasons for providing the necessary insurance coverage for their high-net-worth client’s collections the challenges associated with this unique exposure. Understand valuation issues, appraisal practices, and use actual scenarios to examine the damage assessment process.

In this session, participants will understand the role and function of an insurance adjuster and the importance of their relationship with the insurance agency, avoiding bad faith claims, and misconceptions about coverages and exclusions under certain personal and commercial policies.

While the core fundamentals of insurance have not changed over the centuries, the tools used by insurance agents certainly have. Today’s customer journey often starts online instead of contacting an agent to be their trusted advisor. InsurTech startups such as Lemonade, Pie Insurance, and Next Insurance have changed the way the insurance product is delivered, as well as the coverage clients receive. In this session, participants will explore how they can leverage the digital tools available to them to attract clients, meet their insurance needs, and minimize errors and omissions risk.

Using a hypothetical insurance case study, participants will gain an understanding of the stages of the investigation and litigation including the importance of the insured’s participation in the process. Key policy terms that provide the insurance carrier with tools to successfully investigate and defend lawsuits against insureds will be examined and discussed.

Learn about preparation, prevention, and crisis management for this unique exposure including the basics of Active Shooter Insurance Coverage – what it covers, things to look for in the policy, exclusions to avoid, who needs it, and more.

Every agricultural operation is impacted by environmental exposures. In this session, agents will better understand environmental liability issues affecting commercial farmers, livestock operations, dairy and cattle operations, vineyards and wineries, commercial and botanical gardens, fruit farmers, and more. They will review Federal and State environmental laws and learn how they impact their insureds.

Discover how Dependent Properties Time Element Coverage is designed to pay for the loss of income resulting from damage from a covered cause of loss to the premises of an organization upon which the insured depends, such as an important customer or main supplier. Investigate how to identify the need for this coverage and when changes to it are required.

How It Works

Register

Select Topics

Participate

Complete At Your Own Pace

The On-Demand MEGA seminar includes our most popular pre-recorded James K. Ruble video sessions. Save your progress at any point and view the video sessions at your own pace. This online seminar provides annual update credit.

State CE Credit Not Currently Offered.

- No final exam required

- Includes previously recorded James K. Ruble video sessions

- Complete at your own pace within 60 days

- View the entire self-paced seminar to earn update credit

- Must complete post-program survey for update credit