Design your own advanced topic seminar experience with four or five 4-hour sessions taught by our highly rated faculty in real time!

Select Your Sessions After Registration

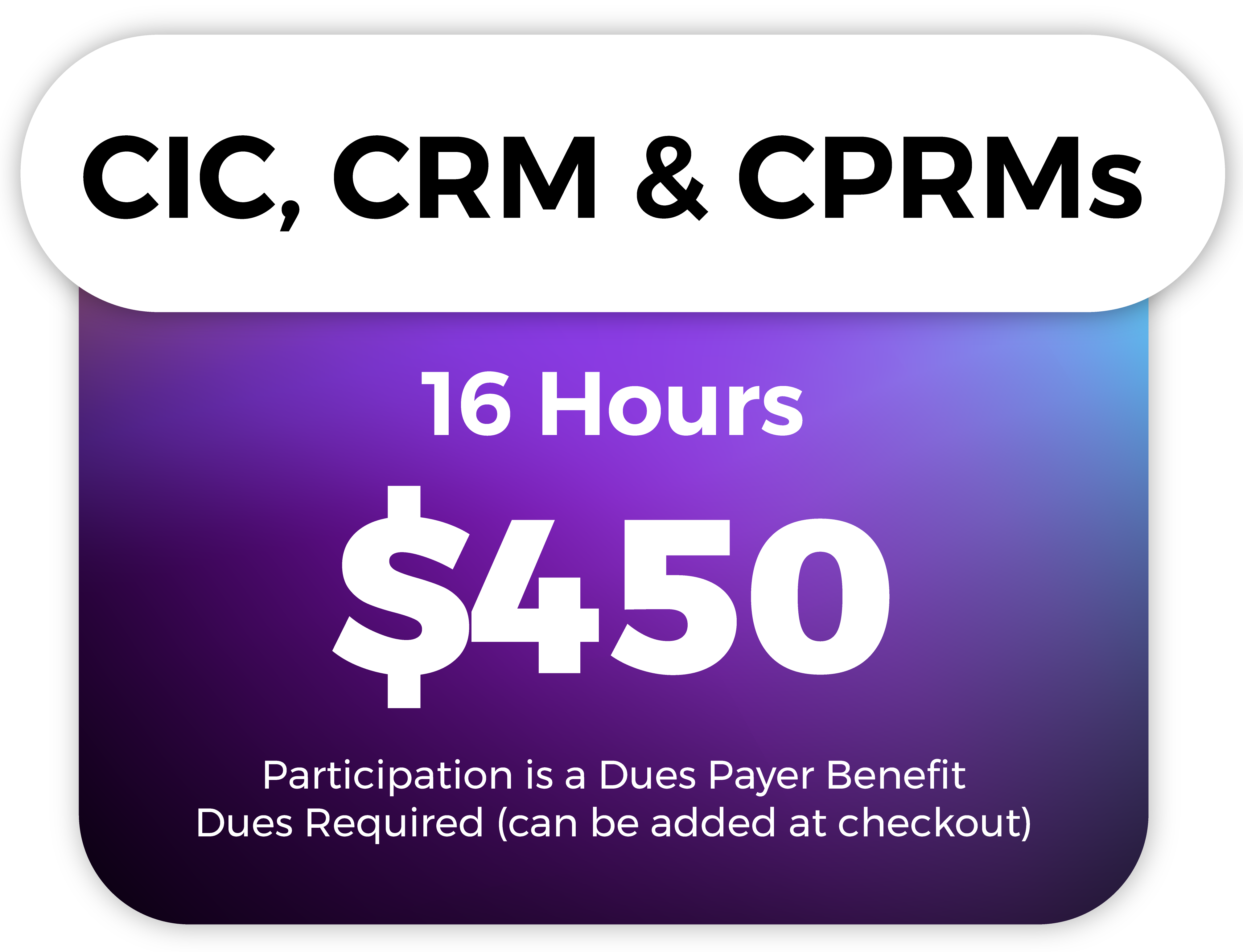

CIC, CRM & CPRMs: Select 4 - 5 sessions.

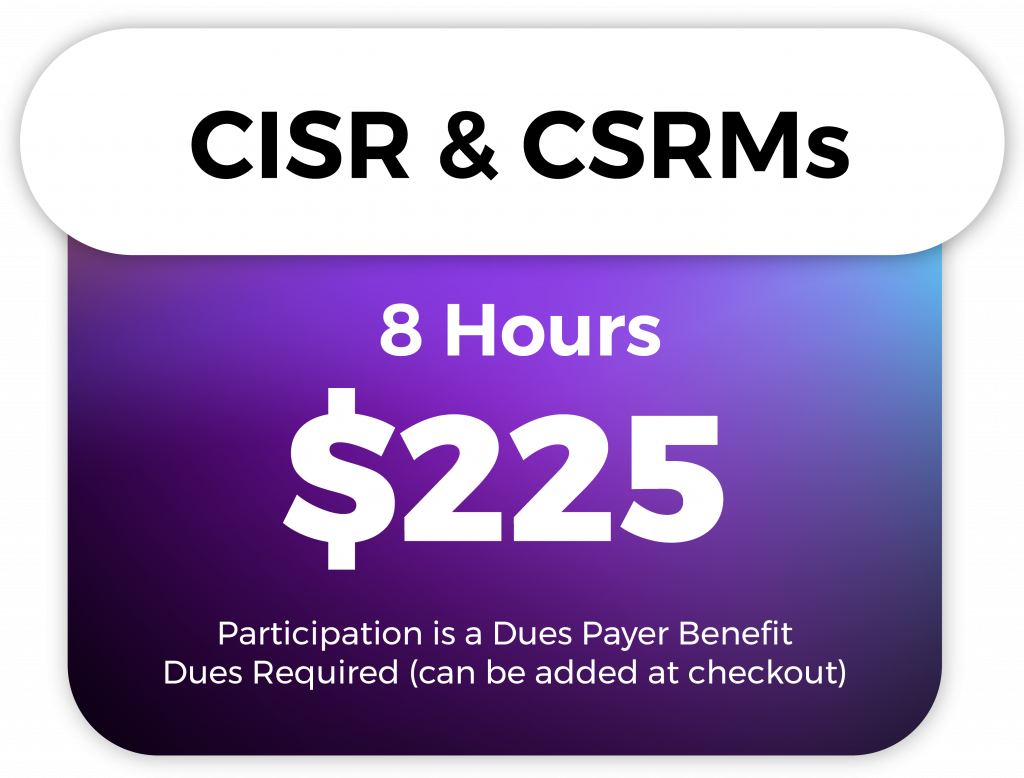

CISR & CSRMs: Select 2 - 3 sessions.

Reserve Your Seat

Select MEGA Sessions

Attend from Anywhere

All Webinars are Presented in Central Time.

2024 MEGA Schedule

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Tues, April 2 (1p-5p) | Steve Lyon | 4 | NEW! Proceed With Caution…Your Client Purchased a Condominium | Participants will analyze significant issues encountered when writing commercial and residential condominium coverage. This 4-hour session begins with an overview of the Champlain Towers South collapse in Surfside, Florida – the facts, the potential causes, the demolition/debris removal/cleanup, the insurance claims, and who is responsible for insurance coverage. Agents will focus on the agreement (bylaws) and the exposure it creates for the association, Board members, and unit owners. Using real-life case scenarios, they will identify the best insurance methods to protect those individuals. They will review coverage and exclusions provided in D&O policies and the latest edition of the ISO Homeowners policies. They will examine the differences between the HO 00 06 (Homeowners 6 – Unit-Owners Form) and HO 00 03 (Homeowners 3 – Special Form). They will discuss ways to close coverage gaps and examine possible solutions to better serve their clients. |

| Mon, April 8 (1p-5p) | Cathy Trischan | 4 | Doing the Right Thing: Ethics for Insurance Producers | Participants will examine the relationship between ethics and the choices insurance professionals make to protect their agencies against errors and omissions. They will discuss the ethical responsibilities of insurance producers, different approaches to decision making, and factors that determine the standard of care. Using real-life ethical dilemmas, they will look at some of the situations faced by insurance producers from ethical and E&O perspectives. |

| Wed, April 10 (1p-5p) | Terry Tadlock | 4 | NEW! Organizational Culture The Solution To Creating An Ethical And Productive Agency | Participants will discuss the importance of ethical behavior. What is it? Why is it important? How does an insurance agency develop it and incorporate it in the remote workforce? In this session, participants will review the professional, legal, and ethical responsibilities in dealing with the day-to-day realities of the complex, ethical issues of the insurance industry. They will discuss the key to ethical decision making. They will examine how to create an ethical team environment in the insurance agency. |

| Thurs, April 18 (10a-12p/2p-4p) | Casey Roberts | 4 | Cannabis, An Evolving Topic – It’s Not Just A Drug | The trend toward mainstreaming and legitimizing marijuana is here and will continue to have a significant impact on the insurance industry. With that trend comes new regulations and a huge number of insurance questions and issues. Even today, there seems to be misunderstanding about the differences between hemp and cannabis. After a brief review of the history of cannabis in the U.S., participants will discuss the legal and regulatory issues. They will learn how the 2018 Farm Bill changed the landscape and what it effectively did. Using current ISO forms, they will examine insurance coverage considerations with farm, general liability, commercial property, as well as endorsements. They will discuss other associated issues and challenges with insuring hemp and cannabis risks including banking problems, transportation, medical marijuana and workers compensation, product liability, D&O, crime, E&O and medical professional, employment practices liability, and cyber. |

| Tues, April 23 (10a-12p/2p-4p) | Bettye Hutchison | 4 | Keep on Truckin’ | Participants will examine information on trucking industry regulatory and compliance issues, insurance coverage forms, and endorsements. They will gain a better understanding of specialty carrier’s non-standard forms. |

| Thurs, April 25 (1p-5p) | Allen Messer | 4 | Contract Analysis for the Contractor by the Insurance Professional | In this session, participants will learn about construction agreements, rental agreements, and lease agreements. They will analyze various contracts and be able to explain the hold harmless agreement, waiver of subrogation, property requirements, subcontractor relationship to general contractor, certificates of insurance, and warranties. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Wed, May 1 (10a-12p/2p-4p) | Charlotte Hicks | 4 | Today’s Insurance Agency: Adapting to an Online World | While the core fundamentals of insurance have not changed over the centuries, the tools used by insurance agents certainly have. Today’s customer journey often starts online instead of contacting an agent to be their trusted advisor. InsurTech startups such as Lemonade, Pie Insurance, and Next Insurance have changed the way the insurance product is delivered, as well as the coverage clients receive. In this session, participants will explore how they can leverage the digital tools available to them to attract clients, meet their insurance needs, and minimize errors and omissions risk. |

| Mon, May 6 (1p-5p) | Ross Pearce | 4 | NEW! Life Insurance…Benefits for the Living | There are several common reasons for buying life insurance, including: to pay for funeral expenses and other final expenses, to provide a financial legacy for heirs, to pay estate or inheritance taxes, to create a savings vehicle, to provide a donation to a charity. In this session, participants will discuss the “living benefits” of life insurance, not death benefits. They will gain a better understanding of the types of permanent life insurance policies – Whole Life, Universal Life, Indexed Life, and Variable Life. They will learn how each type can be used to provide a living benefit to the owner or beneficiaries. They will examine the non-forfeiture options and life insurance policy riders. They will discuss the purpose of a Buy-Sell Agreement and Key Person Insurance. They will learn how life insurance can be used to fund a Life Insurance Retirement Plan (L.I.R.P.). They will review the type and classification of annuity products and learn how they can be used to provide l |

| Wed, May 15 (10a-12p/2p-4p) | Chris Christian | 4 | Peeking Behind the Curtain – What Makes Professional Liability Tick | Participants will advance their knowledge regarding the purpose and structure of professional liability coverage and policies, as well as, gain an increased technical understanding of exposures and coverages pertinent to both traditional professionals and non-traditional classes of business. |

| Fri, May 17 (10a-12p/2p-4p) | David Pagoumian | 4 | NEW! The Art & Science of (Catastrophe) Property Placements | This 4-hour course provides insurance professionals with a better understanding of how technology is changing the evaluation and pricing of risk. Emphasis is placed on the art of risk calculation and loss stratification and how to effectively incorporate them into a well-planned placement effort that can guide underwriters to the optimal program structure and pricing. Using Lloyd’s Realistic Disaster Scenarios (RDS), they will discuss industry loss level, exposure information, coverage specifications, program and alternate program structures, underwriting requirements, etc. They will examine how valuations are determined and looming exposures that can change them. They will better understand the reasons why insurance professionals must insure to the catastrophic loss exposure. |

| Tues, May 21 (10a-12p/2p-4p) | John Dismukes | 4 | Errors and Omissions Prevention vs. Mitigation | Errors and Omissions occur regularly and some of these lead to claims against agents, brokers, agencies, and companies. In this session, participants will examine the leading causes of error and omission claims, identify potential exposures, discuss ways to minimize them, and explain what to do if a claim is made against them. |

| Thurs, May 30 (1p-5p) | Steve Lyon | 4 | Personal Lines Troubles and Solutions | In this session participants will identify the problems and discuss possible solutions to better serve their Personal Homeowners and Auto clients. Prepare to discuss issues related to host liquor liability, coverage for students away at school, damage to residence premises rented to others or premises under renovation, earthquake and flood coverage, and more. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Tues, June 4 (1p-5p) | Jerry Kennedy | 4 | Toys, Toys and More Toys! | ATVs, dirt bikes, Segway, watercraft, and other motorized toys – Oh My! In this session, participants will gain an understanding of exposures for owning and renting recreational vehicles and learn just how much coverage is provided through the ISO Personal Automobile and Homeowners policies – including available endorsements. As well, participants will explore coverage within recreational vehicle policies, motorcycle policies, watercraft policies, and the Personal Umbrella policy. |

| Mon, June 10 (10a-12p/2p-4p) | Patrick Deem | 4 | Workers Compensation Issues and Trends | By the end of this session, you will understand coverage areas of Workers Compensation and Employers Liability that are often overlooked. You will examine the impact of an aging workforce on the Workers Compensation marketplace. You will identify issues related to Waiver of Subrogation and the use of Independent Contractors. You will look at the Experience Modification system, its purpose, characteristics of the system, problems that can arise with the system, and discuss how these problems can be addressed. |

| Wed, June 12 (1p-5p) | Charlie Matejowsky | 4 | The Secure Act | The SECURE Act became effective late last year and will usher in some of the most sweeping changes to retirement plans in decades. After an overview of significant retirement laws, agents will discuss the purpose of the SECURE Act. They will better understand some of the key changes outlined in the act. They will examine how the SECURE Act impacts employer-sponsored retirement plans, defined contribution plans, defined benefit plans, individual retirement accounts, and 529 plans. They will identify and consider retirement planning solutions, including life insurance, for issues created because of this act. |

| Tues, June 18 (10a-12p/2p-4p) | Tim McClendon | 4 | Cyber Risk – Exposures and Products | This session provides an introduction to e-commerce issues and opportunities, including areas of agent concentration, technology E&O issues, and common cyber threats. Agents will identify possible solutions to the unique exposures and coverage gaps present in e-commerce risks. |

| Mon, June 24 (1p-5p) | Ross Pearce | 4 | Gaps in Homeowner’s Policies Due to Changes in Family Dynamics | Participants will discuss new and current homeowner’s issues that insureds face today due to the changes in family dynamics. They will examine coverages and exclusions provided in the latest edition of the Homeowners Policy. Using real-life scenarios, they will learn how the Homeowners Policy provides or excludes coverage for exposures, such as: residence premises, tiny houses, persons living together, other structures on premises, homes rented to others, aircraft (drones), electric bikes and scooters, ordinance or law, and personal liability claims. They will discuss the exposures, whether the Homeowners Policy provides adequate coverage for the exposures, ways to close the coverage gaps using endorsements, and other possible solutions to better serve their clients. |

| Wed, June 26 (10a-12p/2p-4p) | Keith Wilts | 4 | Solving the Mysteries of Business Income Coverage and Claims | Adjustment of a business income loss is an art rather than a science. A successful conclusion is when a claimant seeks an agreement that the insured has returned as closely as possible to the same financial position that would have existed if no loss had occurred. Examine the business income and extra expense insurance risk analysis process, application completion, worksheet considerations, limit of insurance, coverage issues, and negotiating a loss of income or extra expense claim. Discuss key differences in writing manufacturing and mercantile risks. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Tues, July 2 (1p-5p) | Steve Lyon | 4 | Diagnosing Issues in the CGL Policy | This session explores the variety of liability exposures and the insurance coverage designed to address these specific concerns. They will discuss the differences that exist between occurrence and claims-made triggers, the allocation of loss payments that span multiple policies, and how to remedy the coverage gaps that are presented by some of the GL exclusions. |

| Mon, July 8 (1p-5p) | Cathy Trischan | 4 | Commercial Property Concepts Your Client Will Be Glad You Understand | In this session, agents will identify potential pitfalls that could create problems and examine ways to solve them. Topics will include valuation, debris removal, ordinance or law, and vacancy as they pertain to the Building and Personal Property Coverage Form, as well as the Legal Liability and Leasehold Interest Coverage Forms. |

| Wed, July 10 (1p-5p) | Keith Wilts | 4 | When the Business and Personal Automobile Policy Collide | Participants will examine the differences between the Personal Auto Policy (PAP) vs. the Business Auto Coverage Form (BAC/BAP), including “who is an insured,” eligibility, exclusions, and endorsements to provide the proper protection for the insured. They will learn how the PAP and BAP provide or exclude coverage for autos used in business and autos used for business and personal activities. Following this session, participants will be able to explain how coverage applies to individually owned autos used in business, autos owned by corporations and leased to employees, leased autos, and rented autos. They will examine personal auto liability coverage problems for vehicles used for livery and/or delivery and furnished autos. They will identify limitations and exclusions for electronic equipment and custom equipment. They will study problems associated with rental cars and other vehicles a person may have available for their use. |

| Tues, July 16 (10a-12p/2p-4p) | Chappy Chapman | 4 | Personal Lines Claims Issues | Using a question and answer format, agents will discuss how the Personal Auto and Homeowners Policies provide or exclude coverage. Participants will discuss how the PAP provides or excludes coverage for exposures, such as: students away from school, persons living together without the benefits of marriage, personal vehicles purchased through a company owned by the insured, motorized vehicles, rental cars, and vehicles used for livery and/or delivery. They will look at how the Homeowners Policy provides or excludes coverage for identity theft, business in the home, homes put in the name of a trust, and more. |

| Thurs, July 18 (1p-5p) | Crystal Uebelher | 4 | Deposition Success in Five Steps | In this 4-hour session, agents will explore the purposes of depositions and how to prepare themselves or their clients to successfully represent their position. Using a premises liability lawsuit case study, they will examine how lawsuits begin, the parties to a lawsuit, rules of civil procedure, and remedies to successful lawsuits. |

| Wed, July 24 (10a-12p/2p-4p) | Charlie Matejowsky | 4 | Understanding and Managing the 3 Big Government Benefits: Social Security, Medicare and Medicaid | Participants will be introduced to the three major government programs available to most U.S. citizens. They will learn the requirements to qualify for the programs, the benefits these programs have, and the gaps that exist. |

| Tues, July 30 (10a-12p/2p-4p) | Ted Kinney | 4 | NEW! Exploring Personal Auto Claims & Coverage Scenarios | Using various case scenarios, adjusters will review the most current ISO Personal Auto Policy and endorsements to determine if the loss or situation is covered. They will discuss the claims and coverage scenarios, determine if the loss or situation is covered, and identify endorsements that may be needed to cover or expand coverage for the exposure. They will examine how the PAP provides or excludes coverage for exposures, such as: replacement vehicles, roommates driving covered autos, truck rental for personal use, hitting an animal, sunken car leaking oil in a lake, newly acquired autos, unlisted vehicles, vehicles used for livery and/or delivery, rental car, loading and unloading a vehicle, driving for Uber, death of a foster child, named insureds and divorce, and more. They will identify the problems and discuss possible solutions to better serve their clients. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Thurs, Aug 1 (10a-12p/2p-4p) | Craig Stanovich | 4 | Employment-Related Practices Insurance | Participants will review the background of the traditional “at-will” doctrine and statutory legal requirements, the major federal employment related laws, and major state statutes. They will examine an employment-labor law audit and EPLI insurance and analyze an EPLI policy. |

| Tues, Aug 6 (1p-5p) | Allen Messer | 4 | Property Exposures and Coverages for Contractors | Contractors have some unique property exposures. This course will walk participants through some important coverage considerations, including Builders Risk, Installation Floaters, and Contractors Equipment Floaters. |

| Mon, Aug 12 (10a-12p/2p-4p) | Bettye Hutchison | 4 | NEW! The What, Where and Why of Insurance Fraud and the Ethical Applications for Today | Insurance fraud affects everyone in the United States and around the world. What is it? This 4-hour session is designed to increase the insurance professional’s knowledge of insurance fraud. They will learn the reasons for it, the increased costs, the explanations for it, the most common types of insurance fraud schemes, how insurance companies are using technology to identify it and prevent it, and the importance of ethics in the insurance workplace to help identify insurance fraud schemes. They will discuss Federal and State statutes used to fight fraud in the insurance industry. Using real-life scenarios, they will identify the diverse types of insurance fraud schemes, such as: auto theft, property/casualty, workers compensation, premium fraud, healthcare, Medicare/Medicaid, and disability insurance fraud. They will also learn about resources available to insurance and risk management professionals, as well as consumers. |

| Wed, Aug 21 (1p-5p) | Steve Lyon | 4 | Cutting Edge Insurance Issues | In this session, agents will identify emerging risks that could have a significant impact on their client’s business, their agency or organization, or even their career, such as: use of Bitcoin and other cryptocurrencies, medicinal and recreational marijuana, solar storms and falling satellites, autonomous vehicles, big data analytics, drones, nanotechnology, and ridesharing. They will discuss the exposures, coverage issues and gaps with traditional insurance policies, and explore possible insurance solutions to these unique risks. |

| Thurs, Aug 29 (10a-12p/2p-4p) | John Brunette | 4 | Inland Marine Insurance | This 4-hour course will provide participants with an overview of the Nationwide Marine Definition and the distinction between controlled and uncontrolled inland marine lines. They will identify and examine current coverage issues, problems, and trends associated with key commercial inland marine coverages. They will discuss property in transit, owners vs. carriers vs. transportation, warehouse legal liability, construction and installation exposures, and technology. They will learn how a typical inland marine policy is constructed including covered property, property not covered, common coverage extensions, covered causes of loss, and other provisions. They will examine key features in the transportation forms, contractors’ equipment policies, warehouse legal liability policy forms, and technology forms. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Thurs, Sept 5 (10a-12p/2p-4p) | David Pierce | 4 | Integrating Life, Annuity and Long Term Care for Business Owners | Participants will learn how life and health insurance products take the uncertainty out of business planning. The program will specifically discuss the risks that face every business owner, death, disability and retirement, and how to mitigate these risks. |

| Tues, Sept 10 (1p-5p) | Terry Tadlock | 4 | NEW! Commercial Insurance Issues That Cause Heartburn | Using various claim situations, insurance professionals will identify some common coverage issues that create problems. They will discuss issues related to setting building limits, coinsurance, valuation, business auto symbols, drive other car coverage, damage to property, liquor liability, and loading and unloading. They will review the appropriate policy and endorsements and determine whether coverage is provided and how best to address any gaps in coverage. |

| Mon, Sept 16 (1p-5p) | Neil Pinsker | 4 | Healthcare Revealed – Health Insurance Delivery System | Participants will examine how the healthcare industry has evolved from the 18th century to 2021 and COVID-19. They will take an in-depth look at the current state of affairs including employer-sponsored health insurance, Medicare and Medicare Advantage, Medicaid and individual health plans, consumer-driven health care coverage options, unique cost drivers, administrative healthcare costs, and other reasons for the increase in health care costs. Participants will learn how the healthcare delivery system has evolved from indemnity (no network) to managed care to integrated delivery systems. The session will end with a discussion on solutions to improving the quality of healthcare, and what the future hold may hold. |

| Wed, Sept 18 (10a-12p/2p-4p) | Ross Pearce | 4 | When the Child Becomes the Parent | Individuals “sandwiched” between aging parents and their own children are referred to as the sandwich generation. In this session, participants will identify the challenges of taking care of an aging parent and what resources are available, focusing on insurance options. They will discuss the government-based health care coverage plans including Social Security, Medicare, and Medicaid as they relate to Long-Term Care and Long-Term Care Insurance. They will understand the need for LTC Insurance, what it is, what it costs, what services it covers, and who should purchase it. They will review the types of LTC Policies, common LTCI provisions and options, and issues designing the LTC Policy for their clients. They will examine the medical underwriting issues and LTC Policy alternatives. |

| Thurs, Sept 26 (1p-5p) | Patrick Deem | 4 | What’s Your Opinion? (Case Examples Using CGL, WC, and CPP) | Using case scenarios, participants will learn how the CGL, Workers Compensation, and Commercial Property policies provide or exclude coverage. They will understand the CGL insuring agreement, contractual liability, additional insured issues, BI covered loss, BOP-valuable papers, workers compensation-international coverage, certificates of insurance and more. Agents will identify methods of covering the loss if it were excluded and review the outcome of each case. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Tues, Oct 1 (1p-5p) | Allen Messer | 4 | NEW! Commercial Property Casualty Issues & Answers | Every insurance agency needs a formal method for exposure identification to better serve their clients. Every insurance agency should establish coverage standards. Coverage standards include needed coverages and endorsements and avoided endorsements. In this 4-hour session, participants will identify current commercial coverage issues that could have a significant impact on their commercial client’s business, agency, or organization. They will discuss the exposures, coverage issues, and gaps with traditional insurance policies – Commercial Property Policy, Commercial General Liability Policy, Business Automobile Policy Coverage Form, Workers Compensation and Employers Liability Insurance Policy, and Excess Liability/Commercial Umbrella. They will discuss coverages provided in each policy, as well as endorsements that may be needed to further tailor coverages to the specific exposures. |

| Mon, Oct 7 (10a-12p/2p-4p) | John Dismukes | 4 | Are These Personal Lines Losses Covered? | In this session, participants will use real claim examples to discuss problems and possible solutions to Homeowners Policy exclusions that limit or remove coverage for dwellings rented to others, personal liability, co-habitation, motorized vehicles, home-sharing, and ownerships. Participants will also discuss ISO Personal Auto Policy exclusions for furnished vehicles, non-owned autos, and various uses. |

| Wed, Oct 9 (10a-12p/2p-4p) | Rick Pitts | 4 | Crisis Response for Insurance Professionals: How to Assist an Insured’s Response to a Crisis | Do you know what to do when a crisis occurs? Uncover the insurance implications and general principles of crisis response for active assailants, product recalls, and data breach/cybersecurity incidents. Analyze a data breach claim and form a plan of action. |

| Thurs, Oct 17 (1p-5p) | Bob Ford | 4 | NEW! Commercial Property – You Better Sweat the Small Stuff | In this session, participants will identify potential coverage pitfalls that could create problems and examine ways to solve them. They will review the appropriate Commercial Property policies and endorsements, such as the Building and Personal Property Coverage Form, as well as coverage for Landlords and Tenants, Ordinance or Law, Legal Liability Form, Leasehold Interest Coverage Form, and Protective Safeguards endorsements. They will discuss insurable interest in commercial property – who is the owner of the property, who is responsible for the property, and who will suffer financially if the property is damaged or destroyed. They will examine issues related to tenant’s improvements and betterments. They will identify various types of valuation and how each one works in a claim situation. They will look at how Ordinance or Law is addressed in a claim situation. They will learn the importance of Protective Safeguards endorsements – the purpose and how they work. |

| Tues, Oct 22 (10a-12p/2p-4p) | Chris Christian | 4 | NEW! Construction Risk – What’s not in the CGL | The potential for professional liability claims may seem apparent when considering services such as engineering or construction management. In this 4-hour session, insurance professionals will explore exposures beyond the typical commercial general liability, workers compensation, and commercial auto exposures in the construction industry. They will examine the types of coverages for ancillary exposures, such as: contractors pollution, contingent pollution, contractors professional liability, rectification costs coverage, protective indemnity coverage, network security/privacy liability, technology, faulty workmanship, etc. They will identify emerging risks that could have a significant impact on the construction industry, such as: automated/autonomous construction machinery, robotics, drones, and artificial intelligence. They will discuss the exposures, coverage issues, and gaps with traditional insurance policies and explore possible solutions to these emerging and unique risks. |

| Thurs, Oct 24 (10a-12p/2p-4p) | Paul Burkett | 4 | Cyber Liability – How Your Client Survives in a Connected World | Participants will gain a better understanding of cyber risk exposures and why businesses need cyber liability coverage. They will examine first-party and third-party exposures related to cyber risks, coverage limitations in standard liability policies, and major provisions commonly found in cyber liability insurance policies. They will review solutions that include cyberspace specific products and risk management. |

| Tues, Oct 29 (1p-5p) | Keith Wilts | 4 | NEW! Home-Based Businesses: Where Personal Ends & Commercial Begins | Insurance professionals will examine property and liability insurance exposures and risk management considerations when insuring home-based businesses and clients who work remotely. They will be able to identify general and unique exposures to loss, types of in-home businesses, risk management considerations, and methods of insuring exposures. They will review the protection provided in the latest edition of personal and commercial lines insurance policies including ISO Homeowners, ISO Personal Automobile, Personal Umbrella, ISO Business Auto Coverage, and ISO Businessowners. They will examine ISO endorsements designed to address the exposures of home-based business. They will discuss in-home business “hybrid” programs. They will identify coverage dilemmas and discuss ways to modify the standard policy and broaden coverage to meet their clients’ needs. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Tues, Nov 5 (1p-5p) | Steve Lyon | 4 | Commercial Lines Troubles and Solutions | Participants examine commercial lines issues that can be troublesome for the insured. They will examine coverages and exclusions provided in the most current ISO Crime, Commercial Property, Businessowners, Commercial General Liability, and Commercial Umbrella forms. They will identify problems and issues with the National Flood Insurance Program. |

| Thurs, Nov 7 (1p-5p) | Jerry Kennedy | 4 | Ethical Issues (Only Approved for 2.5-HRS ETH in MD) | In this session, participants will understand ethical challenges that insurance professionals face, difference between legal and ethical responsibilities and their fiduciary duties and obligations to the customer, insurer, and peers. |

| Tues, Nov 12 (1p-5p) | Sam Bennett | 4 | Personal Lines and The Sharing Economy | Participants will examine the concerns that exist when clients offer property and/or use property of others via popular web-enabled services such as VRBO, Couchsurf, Airbnb, and similar platforms. They will explore the most commonly used Homeowners Coverage forms, Personal Auto Policy, Recreational Vehicle Coverage forms, Watercraft policies, and the endorsements that can be used to provide coverage for these unique exposures. They will better understand the coverage issues that may arise when these items are shared with others. |

| Mon, Nov 18 (10a-12p/2p-4p) | Terry Tadlock | 4 | NEW! Insurance and the Property Lease | Using various claims situations, participants identify and examine the issues and problems when providing property insurance protection for an insured whose insurable interest is created through a lease or other form of “contractual” arrangement. They will identify provisions found in leases of real property that may impact how property insurance should be written. They will discuss when and under what conditions subrogation may be waived in the Commercial Property Coverage forms and examine the impact of a “Mutual Waiver of Subrogation” clause found in property leases. They will identify how Tenant’s Improvements and Betterment should be written and how losses will be valued at the time of loss. They will discuss how to insure and value personal property that is leased by an insured. They will review other miscellaneous leases, such as contractor’s equipment and apartments for kids away at college. |

| Date being Presented | Faculty | Topic Length (hours) | Topic Title | Description |

| Mon, Dec 2 (10a-12p/2p-4p) | Tim McClendon | 4 | Decision Risks and Coverages for Executive Risks | Participants will explore Directors and Officers Liability, Employee Benefits Liability, and Fiduciary Liability issues faced by business owners. They will be able to explain why this coverage is needed and learn ways to offer this coverage in the most economical fashion. |

| Wed, Dec 4 (10a-12p/2p-4p) | Ross Pearce | 4 | Challenges Correctly Covering Condos & Cars | Participants will analyze significant issues encountered when writing residential condominium coverage. They will examine coverages and exclusions provided in the latest edition of the Homeowners 6 – Unit-Owners Form. They will discuss key definitions and examine the differences between the HO 00 06 and HO 00 03 (Homeowners 3 – Special Form). They will discuss ways to close coverage gaps using HO endorsements and examine possible solutions to better serve their clients. They will discuss the challenges with providing insurance coverage for Transportation Network Companies (TNCs), electric bikes and scooters, and autonomous driving vehicles. They will review coverage issues, as to what is or is not covered by the PAP and explore potential solutions to fill the gaps to better serve their insureds. |

| Tues, Dec 10 (1p-5p) | Ted Kinney | 4 | Certificates of Insurance: The Bane of Our Existence | Insurance certificates can be one of the more dangerous documents that float between insureds and insurers. In this session, participants will learn the importance of a certificate of insurance and how to use it properly to protect their clients from unexpected and unintended contractor exposures. They will examine the purpose of a certificate, critical details to consider before issuing a certificate, and typical contract requests for inclusion on certificates. They will identify common problems and mistakes when issuing certificates and discuss ways to avoid these common problems and errors. |

| Mon, Dec 16 (1p-5p) | Neil Pinsker | 4 | Healthcare Revealed – Health Insurance from the Consumer to the Companies | Participants will examine the healthcare industry from the consumer to the insurance companies. They will look at the health insurance industry from the perspective of insurance brokers, employers that purchase health insurance on behalf of their employees, and the ultimate consumer end user. They will discuss the distribution system for employer-paid plans, consumer-paid plans, non-employer sponsored plans, and brokers and consultants. They will compare the strengths and weaknesses of the major players in the healthcare industry today. They will discuss funding options used by health insurance companies – fully insured, self insured, and self insured + stop loss. They will examine how dental insurance is similar and different from medical insurance. They will learn how pharmacy insurance works and the role of the Pharmacy Benefit Manager (PBM). |

Attend Live Online Sessions

The Online Ruble MEGA Seminar is approved for CE and designation update credit, includes practical content you can use immediately, and is taught by our highly rated faculty in real time.

- Practical content

- Taught live by nationally recognized industry practitioners

- Full attendance required for update or CE Credit

- No final exam required

How To Select Sessions

Watch & Learn How To Select Sessions

“What I loved about the new online MEGA is the flexibility to take one’s 16 hour update over the entire year, with several offerings to choose from. While I only needed 4 of the online MEGA topics to fulfill my 16 hours, there are additional topics of interest that I am taking through the year end offering…one isn’t limited to just the 4 update topics.”

PREFER LEARNING AT YOUR OWN PACE?

Try the NEW ON-Demand James K. Ruble Online MEGA!

The NEW On-Demand Online MEGA Seminar satisfies your update requirement.

Log on any time, day or night, 24/7.